The financial world is undergoing a seismic transformation. As the traditional banking system faces growing criticism over inefficiencies, lack of transparency, and centralized control, a powerful new movement has emerged Decentralized Finance (DeFi). By leveraging blockchain technology, DeFi aims to eliminate intermediaries, democratize access to financial tools, and enable a programmable, transparent alternative to legacy finance systems.

What started as a niche experiment in the crypto space has now evolved into a multi-billion-dollar global phenomenon, encompassing everything from decentralized lending to algorithmic insurance and tokenized investment products. DeFi doesn’t just improve financial services it reimagines the very architecture of trust and value exchange.

What is DeFi? A New Financial Architecture

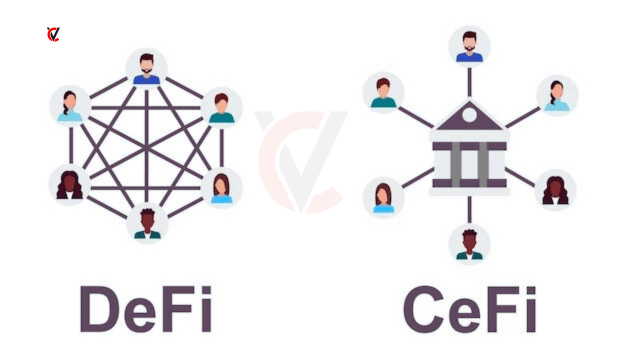

At its core, DeFi is an ecosystem of decentralized applications (dApps) built on blockchain networks such as Ethereum, Solana, Avalanche, and Binance Smart Chain. These apps use smart contracts self-executing pieces of code to run financial protocols for lending, borrowing, trading, saving, and more. These contracts are open-source and non-custodial, meaning users interact directly with the code, not a human intermediary.

Unlike traditional systems that are permissioned, DeFi is open to anyone with a crypto wallet and an internet connection. This open access is especially transformative for underserved or excluded populations who lack access to traditional financial infrastructure. DeFi also enhances transparency because every transaction is recorded on the blockchain, allowing for real-time auditing and analysis.

The Core Components of the DeFi Stack

- Stablecoins (USDC, DAI, USDT): These are crypto assets pegged to fiat currencies like the US dollar, offering price stability in volatile markets. They serve as the backbone of most DeFi transactions, including loans, trades, and savings.

- Lending & Borrowing (Aave, Compound): DeFi lending protocols allow users to deposit crypto assets and earn interest. Borrowers can take loans by locking up collateral. Interest rates are algorithmically determined based on market demand and supply, removing the need for credit scores or banking approval.

- Decentralized Exchanges (Uniswap, Curve): DEXs allow users to trade crypto assets directly from their wallets using liquidity pools instead of order books. This means lower fees, increased privacy, and no need to trust a central authority.

- Yield Aggregators (Yearn Finance, Beefy): These tools help users maximize returns by automatically moving funds between different DeFi platforms based on the best yield opportunities similar to robo-advisors in traditional finance.

- Synthetic Assets (Synthetix): These are blockchain-based tokens that mimic the value of real-world assets like stocks, commodities, or indices. They allow global, 24/7 trading of assets that are normally limited to specific markets or regions.

- Insurance (Nexus Mutual, InsurAce): DeFi insurance protocols allow users to pool funds and provide coverage against smart contract failures, exchange hacks, or governance attacks building risk mitigation mechanisms for the decentralized future.

Real-World Use Cases and Value Creation

🌍 Financial Inclusion

Over 1.4 billion people around the world remain unbanked due to geographical, political, or economic barriers. DeFi platforms, which only require an internet connection and digital wallet, enable these individuals to access services like lending, borrowing, saving, and investing without a traditional bank. For example, farmers in sub-Saharan Africa can now access working capital through blockchain-based microloan platforms.

💸 Low-Cost Remittances

Remittances are a lifeline for millions, yet traditional services like Western Union or MoneyGram charge high fees and impose delays. With DeFi, people can send instant, low-cost, cross-border payments using stablecoins like USDC or DAI, often settling in seconds. Protocols like Celo and Stellar are already helping families move funds more efficiently between continents.

🏘️ Tokenized Real Estate

Through platforms like RealT and Landshare, users can buy fractional ownership of rental properties, earn daily passive income in stablecoins, and even participate in governance decisions regarding the assets. This brings real estate investment to the average person and makes assets that were once illiquid into liquid, tradeable tokens.

🔄 Flash Loans

Flash loans are unique DeFi instruments that allow users to borrow massive amounts of capital without any upfront collateral so long as the loan is repaid within the same blockchain transaction. These are used for arbitrage, refinancing, and protocol interactions. While they’ve enabled novel financial strategies, they’ve also been exploited in high-profile hacks, underscoring the need for better security and smart contract design.

How DeFi Differs From Traditional Banking

| Aspect | Traditional Banking | DeFi |

|---|---|---|

| Access | Restricted by geography, KYC, and credit history | Global, open to anyone |

| Intermediaries | Requires banks, clearinghouses, regulators | Peer-to-peer, run by code |

| Fees | High service and transaction fees | Low, transparent fees |

| Transparency | Closed systems, proprietary data | Fully transparent and on-chain |

| Innovation | Bureaucratic and slow-moving | Community-driven and fast-paced |

| Ownership | Users rely on banks to hold their money | Users maintain full custody |

Risks and Challenges

Despite its disruptive potential, DeFi is still in its early stages and faces a range of challenges:

- Smart Contract Vulnerabilities: Bugs or coding errors can be exploited. Millions have been lost to poorly audited or unaudited contracts.

- Scalability Issues: High gas fees on Ethereum and network congestion still limit accessibility, although Layer 2 solutions are improving this.

- Regulatory Uncertainty: Governments are increasingly scrutinizing DeFi. Lack of clear regulation creates uncertainty for users, developers, and investors.

- User Complexity: DeFi interfaces and processes remain complex, making onboarding difficult for non-technical users. Improved UX/UI and educational content are key to adoption.

CeDeFi and Institutional Adoption

Traditional financial institutions are beginning to embrace DeFi principles while maintaining compliance standards giving rise to CeDeFi (Centralized-Decentralized Finance). Binance, for example, blends KYC processes with access to decentralized protocols. Similarly, Visa and Mastercard are integrating stablecoin settlements into their infrastructure. Major asset managers like BlackRock are exploring tokenized funds, while JPMorgan is conducting blockchain-based repo transactions. This fusion of TradFi and DeFi signals a hybrid future where decentralized infrastructure underpins financial products governed by regulatory frameworks.

🔮 What the Future Holds: The Road Ahead for DeFi

As decentralized finance continues to evolve, several emerging trends and technologies are set to shape its trajectory. The future of DeFi is not just about replicating traditional finance on the blockchain it’s about inventing entirely new financial mechanisms and redefining global economic infrastructure. Here’s a closer look at what’s coming:

⚙️ Layer 2 Scaling: Faster, Cheaper, More Inclusive

The high transaction costs on major blockchains like Ethereum have long been a barrier to mainstream DeFi adoption. Layer 2 solutions such as Arbitrum, Optimism, zkSync, and StarkNet address this by executing transactions off-chain and then settling them on-chain in bulk. This reduces costs, increases throughput, and opens DeFi to new markets and users with smaller portfolios. In the near future, expect Layer 2s to host full-fledged DeFi ecosystems with their own dApps, tokens, and user bases, creating a multi-layered DeFi world.

🧠 AI Integration in DeFi: Smarter Systems, Safer Protocols

Artificial Intelligence is becoming increasingly intertwined with DeFi. From predictive trading bots to AI-driven lending risk assessment, we’re seeing smarter, self-optimizing systems emerge. Protocols are also experimenting with AI for fraud detection, portfolio management, and even dynamic fee optimization. In the coming years, AI could also help new users by offering intelligent onboarding assistants that recommend strategies, manage assets, or monitor risks in real-time.

🌐 Cross-Chain Interoperability: One DeFi to Rule Them All

Currently, DeFi ecosystems are often siloed by blockchain (Ethereum, Solana, Avalanche, etc.). But the future lies in cross-chain DeFi, where users can move assets and data across multiple blockchains seamlessly. Projects like Cosmos (IBC protocol), Polkadot (parachains), and Chainlink’s Cross-Chain Interoperability Protocol (CCIP) are laying the foundation for an interconnected blockchain universe. This will give rise to global liquidity pools, unified asset management, and richer, cross-chain financial products.

🧱 Real-World Asset (RWA) Tokenization: Bridging Digital and Physical

A major driver of institutional interest is the tokenization of real-world assets. From real estate and treasuries to carbon credits and intellectual property, blockchain is transforming traditionally illiquid assets into fractionalized, tradable tokens. Protocols like Maple Finance, Centrifuge, and Goldfinch are already offering credit markets backed by real-world invoices, business loans, or yield-generating real estate. This opens DeFi to trillions in off-chain value and provides risk diversification for investors.

🪪 Decentralized Identity (DID) and Reputation: Trust Without Centralization

Trust is crucial in finance. DeFi’s next evolution will likely involve decentralized identity systems, enabling users to prove aspects of their identity (KYC, creditworthiness, history) without revealing sensitive data. Platforms like BrightID, Worldcoin, Gitcoin Passport, and Proof of Humanity are experimenting with on-chain reputations that could power uncollateralized loans, social scoring, access control, and DAO governance. Imagine getting a micro-loan based on your on-chain reputation rather than your bank account.

📈 Modular DeFi & Composability: Building With Financial LEGO

One of DeFi’s most powerful advantages is composability the ability to stack protocols on top of one another like LEGO blocks. This is evolving into modular DeFi, where each layer of a protocol (data, execution, consensus) can be customized or upgraded independently. This trend is enabling a new wave of hyper-specialized protocols that plug into shared infrastructure, creating more resilient, interoperable, and customizable financial ecosystems.

🏛️ DeFi Regulation and Institutional Maturity

As DeFi gains traction, regulators are beginning to take it seriously. While this may pose short-term hurdles, clear legal frameworks can accelerate adoption especially from institutions. We’re seeing early signs of this with tokenized treasuries, regulated DeFi protocols, and KYC-compliant liquidity pools. Projects like Aave Arc and Ondo Finance are exploring ways to bridge regulatory requirements with decentralization, opening the door for regulated DeFi (RegFi) and institutional liquidity to enter the space.

🧬 DeFi x NFTs x Gaming: Financial Infrastructure for Digital Worlds

Gaming and the metaverse are fast becoming the next major frontiers for DeFi. In-game currencies, NFT-based assets, and virtual real estate are already being financialized through lending markets and liquidity protocols. Platforms like Aavegotchi, Treasure DAO, and Illuvium are blending DeFi tools with immersive digital experiences, paving the way for play-to-earn economies and user-owned virtual financial systems.

🌱 Green DeFi & Impact Investing

As climate change and sustainability grow in importance, a new wave of “Green DeFi” is emerging. These platforms tokenize carbon credits, support regenerative finance (ReFi) projects, and enable impact-based investment models. Examples include Toucan Protocol, KlimaDAO, and Flowcarbon, which allow users to offset emissions and fund climate-positive initiatives directly through DeFi wallets.

👥 DAO-Powered DeFi: Governance Reimagined

Decentralized Autonomous Organizations (DAOs) are playing an increasing role in DeFi governance. These community-driven structures vote on proposals related to protocol upgrades, treasury allocation, fee models, and partnerships. As tooling improves (Snapshot, Tally, Gnosis Safe), DAOs will evolve into full-fledged financial institutions with the community, not executives, driving innovation and value distribution.

🧩 Financial Hyperstructures

Inspired by Ethereum’s creator Vitalik Buterin, “hyperstructures” are protocols designed to last forever, run autonomously, and resist capture. DeFi is moving toward self-sustaining financial infrastructure, funded by protocol-native revenue and governed by token holders or DAOs, offering free access and perpetual service to global users.

The Financial Revolution Has Just Begun

DeFi represents a paradigm shift not just in technology, but in how we perceive trust, value, and economic participation. It places financial power directly in the hands of users, making financial systems more inclusive, transparent, and resilient. While challenges persist especially in scalability, regulation, and security the potential benefits far outweigh the risks. As infrastructure improves and adoption spreads, DeFi will not just complement traditional finance it may ultimately replace core functions of it. We are witnessing the birth of a decentralized financial operating system for the world. One that operates without borders, without bias, and without permission.

Related Blogs : https://ciovisionaries.com/articles-press-release/